How to Modify a Tax in PrestaShop : 1.5.X.

Taxes are required for sales of your goods within a specific region. These taxes may also apply depending on region to which your goods are being delivered

By default in PrestaShop, a tax applies to all countries/states/zones. If order to apply a specific tax rate for a single country or a set of countries (and not some others), you must create a tax rule. The tax rule is then applied on a per-product basis, during the creation of the product Prices tab.

In PrestaShop, taxes are first defined and then used in a Tax Rule. You cannot directly apply a tax to a product, you can only apply tax rules. Therefore, you must first register all relevant taxes, and then create a tax rule for that tax in order to specify the countries the tax applies, and finally set the tax rule to the product.

In tax data you can change tax rate for particular locales or tax rule behavior.

Modify Tax:

Following are the steps to edit a tax in your PrestaShop store.

-

- Login as an administrator or employer with granted permission into you PrestaShop shop.

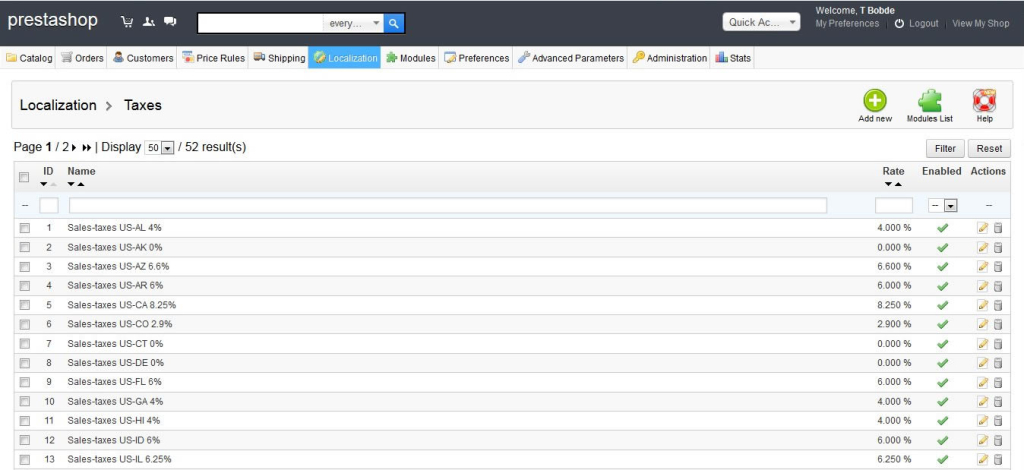

- Next go to Localizations tab on menu bar and click on the Taxes option.

- Now you are in per-defined tax list screen. click on the Edit icon on the right hand side of the row of tax which you want to edit.

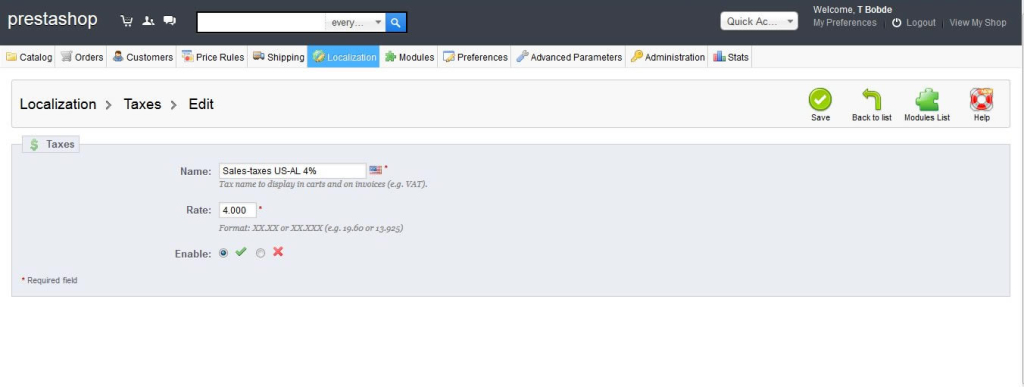

- Now you are on edit tax options screen.

You can edit following tax options.

You can edit following tax options.

- Name: Name of Tax which will be display in carts and on invoices .

- Rate: The actual percentage rate of the tax.

- Enable: You can disable and enable as per your need.

After making the appropriate changes to your tax, click on the Save button in the upper right corner. The changes will then be saved and modified tax changes will be applied everywhere.

Modify Tax Rules:

Following are the steps to edit a tax rules in your PrestaShop store.

- Login as an administrator or employer with granted permission into you PrestaShop shop.

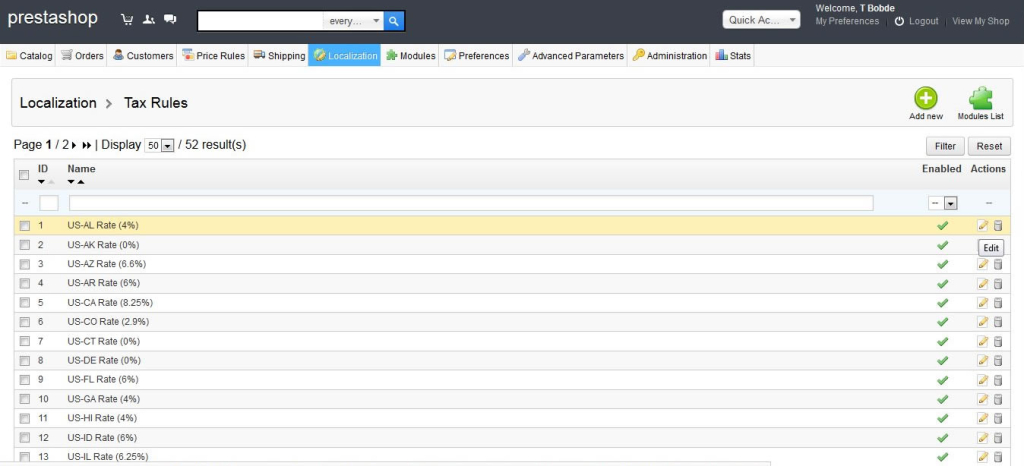

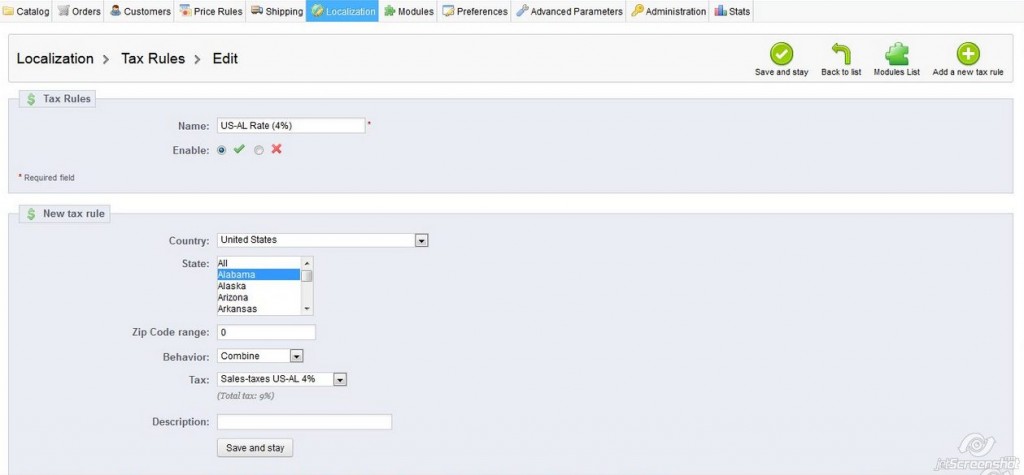

- Go to Localizations tab on menu bar and click on the Tax Rules option.

- Now that you are on Tax Rules list screen, click on the Edit icon on the right hand side of the row of tax rules which you want to edit.

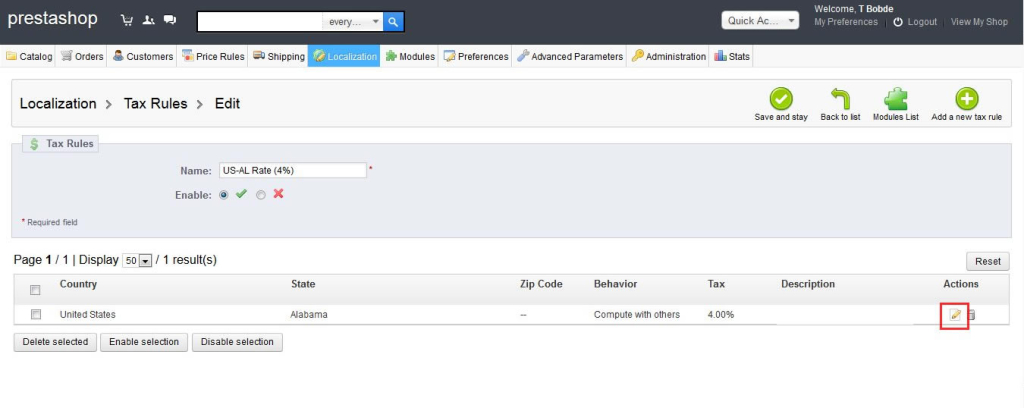

- Above action will leads you to another screen where you will see a lower section with the different locales for the rule. To edit this part of the rule you will need to select the Edit button for that particular locale.

- Now you are on tax rules screen and here you can make any changes on tax rule.

- Country: Select country from drop down.

- State: Select state or group of state from multiselection drop down.

- ZIP Code range: You can define a range (eg: 5000-5015) or a simple zipcode.

- Enable: You can disable and enable as per your need.

- Behavior: Define the behavior if an address matches multiple rules:

This Tax Only: Will apply only this tax

Combine: Combine taxes (eg: 10% + 5% => 15%)

One After Another: Apply taxes one after another

(eg: 100€ + 10% => 110€ + 5% => 115.5€) - Tax: Select appropriate tax from drop down.

- Description: Enter a description about this tax rule.

- After making the appropriate changes to your tax, click on the Save and stay button in the upper right corner. The changes will then be saved.