How To Install Taxjar/SalesTax Module in Magento

How Module Works

With the help of this extension, Taxjar is helpful for solving a problem no one wants to deal with which is sales tax. This is what matters when you want to grow business specially when we obsessively leverage technology and exceptional customer service to help focus on what matters.

Taxjar is a award-winning solution which makes it easy to automate sales tax reporting and filing, and determine economic nexus with a single click and it is trusted by 20,000 businesses. Just to get up and run fast, you need to connect Taxjar directly with your Magento store and Marketplace. To run a business of all sizes, Taxjar provides award-winning support and transparent pricing options.

With the help of sales tax we can easily automate your sales tax when the complexities of sales volume, state nexus and platform needs have multiplied.

With the help of sales tax we can easily automate your sales tax when the complexities of sales volume, state nexus and platform needs have multiplied.

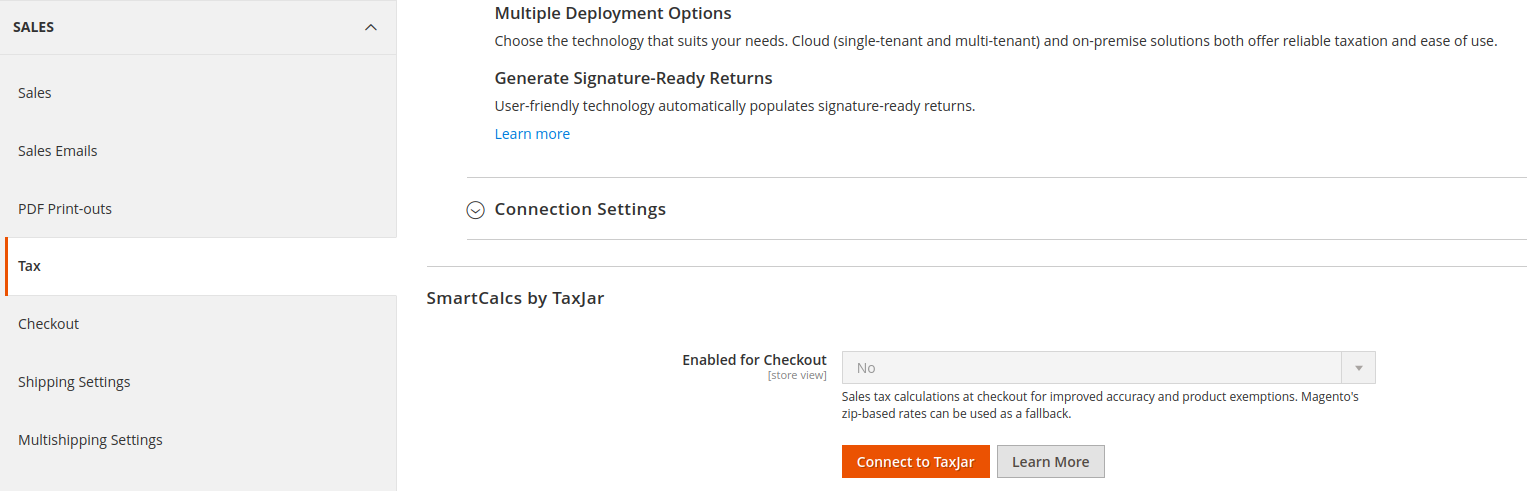

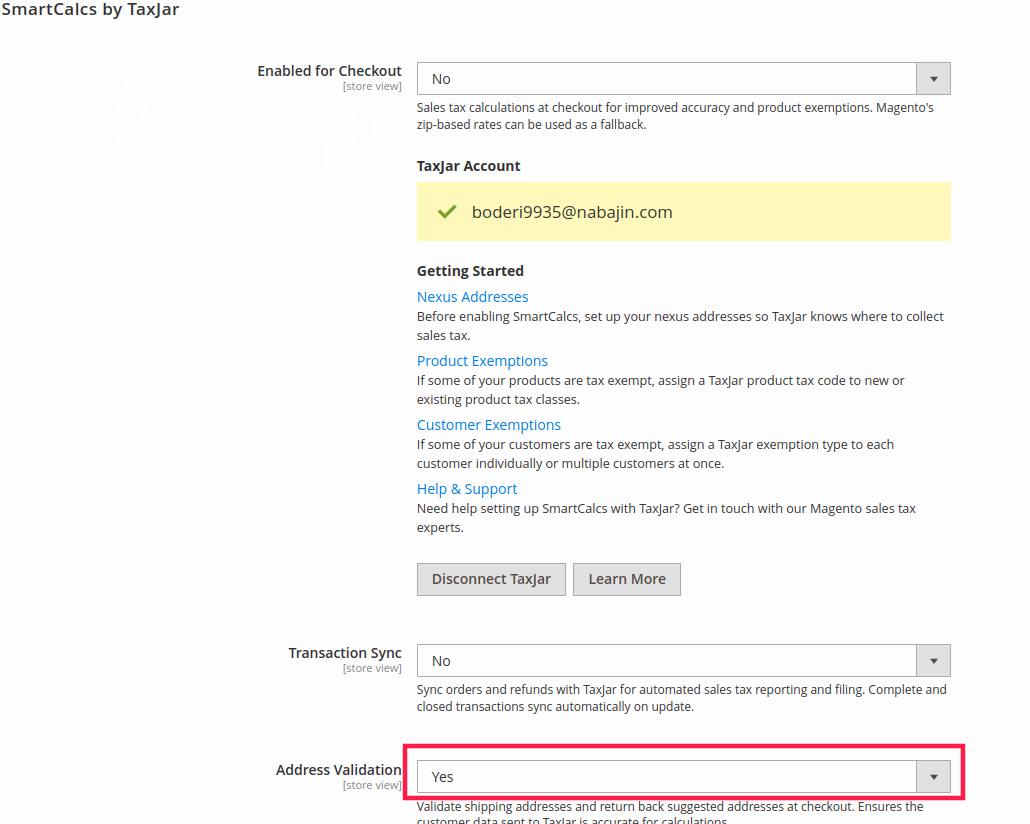

Module’s Flow – After installation, Go to Stores -> Configuration -> Sales -> Tax. To configure the Taxjar Magento 2 extension for sales tax calculations.

Connect To TaxJar :

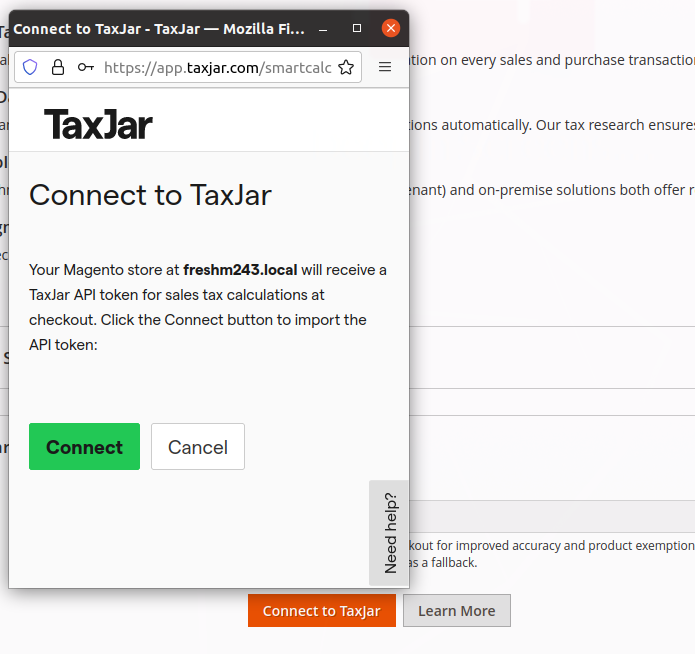

Before enabling, you need to connect to Taxjar from your Magento store. After clicking the Connect To Taxjar button, it will open a popup and will ask you to create a new account or log in to Taxjar. It shows a confirmation screen to import your API token.

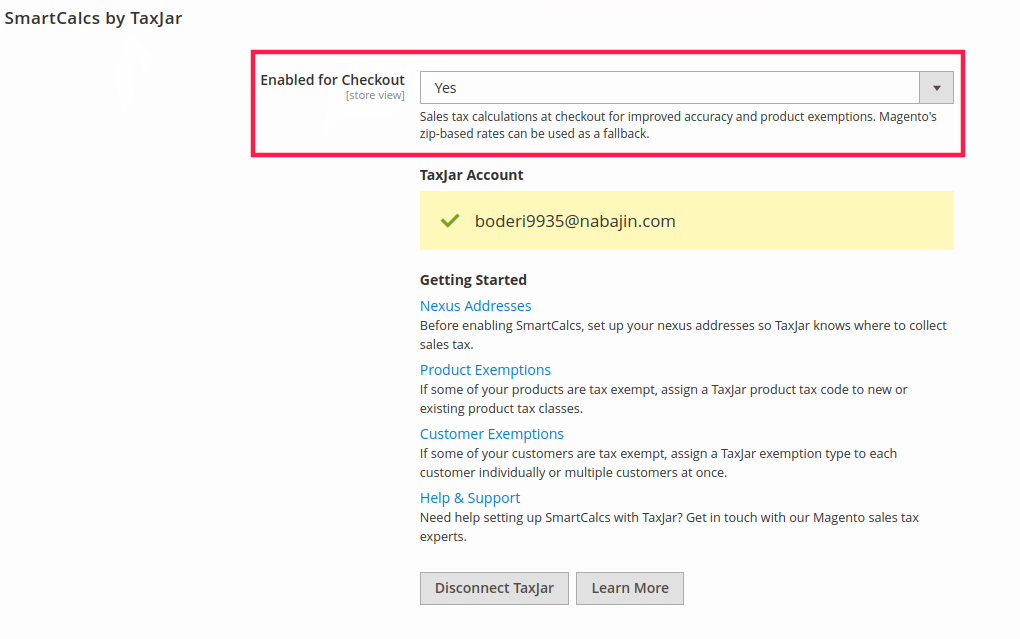

Once we click on Connect button a token will be automatically saved in Magento. Because of that the configuration screen will refresh and show new options.

Enable For Checkout : Enable the Sales tax calculations at checkout for improved accuracy and product exemptions.

There are some options given below in the Getting Started

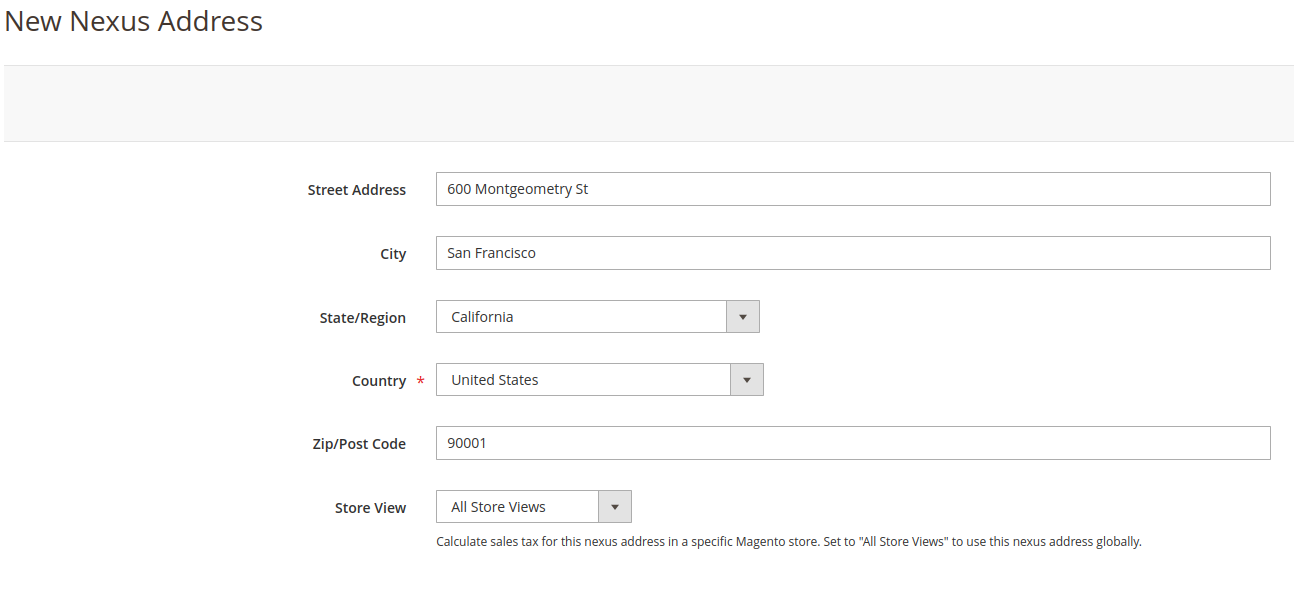

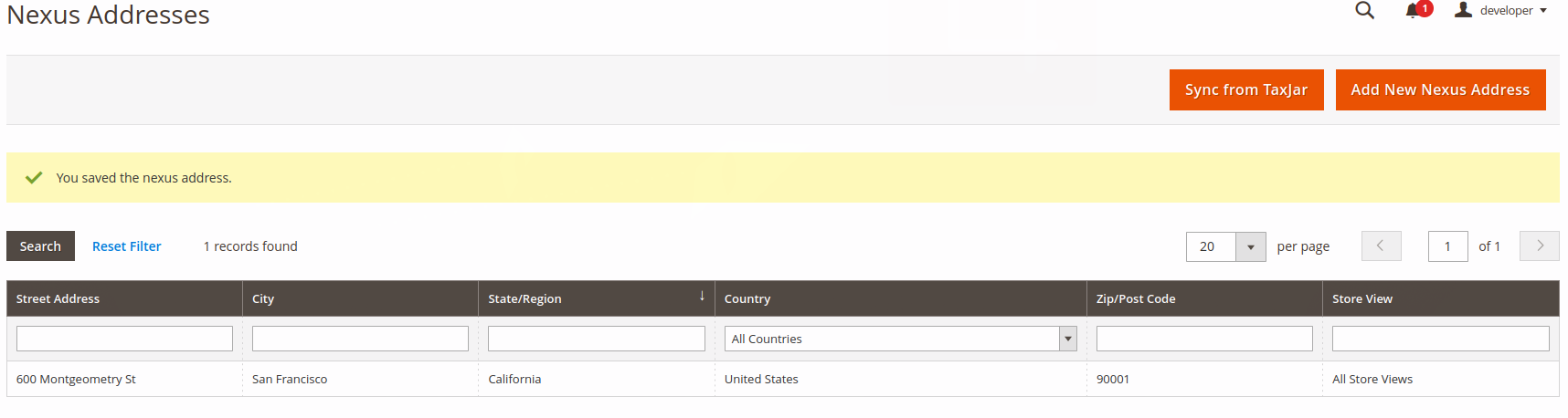

Nexus Addresses : Once we connect to Taxjar, Setup the states where your company has nexus.

It is not necessary that all the states would have the nexus. From the Nexus Addresses settings we can add, change or delete nexus addresses associated with your Taxjar account. If you want to import any of your existing addresses from Taxjar there’s also a Sync from Taxjar button. Just to click on the button it will automatically import addresses.

It is not necessary that all the states would have the nexus. From the Nexus Addresses settings we can add, change or delete nexus addresses associated with your Taxjar account. If you want to import any of your existing addresses from Taxjar there’s also a Sync from Taxjar button. Just to click on the button it will automatically import addresses.

Street Address – Mention the street address of the selected city.

City – Mention the city from the selected State.

State/Region – Select the State

Country – Select the Country

Zip/post Code – Enter the zip code of the selected street address.

Store View – Select the store view. Here is All store view selected.

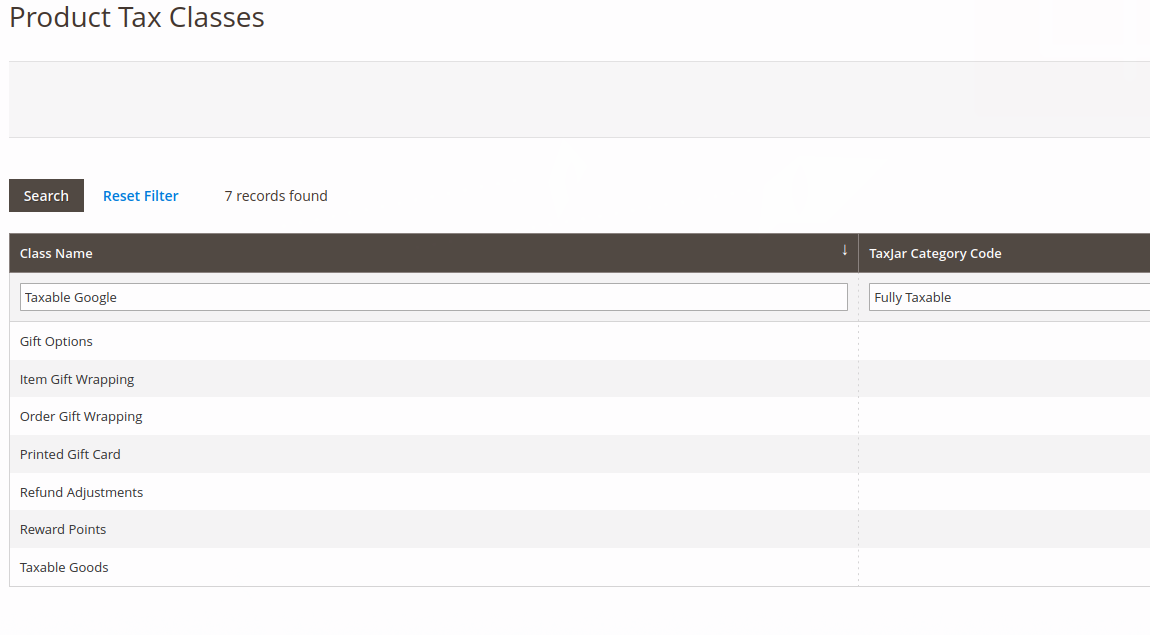

Product Exemptions : Once we connect to Taxjar, you have to assign a Taxjar product tax code to a product tax class in Magento. For setup, click on Product Exemptions link. With the Product Exemptions link, if some of your products are tax exempt assign a Taxjar product tax code to new or existing product tax classes. By clicking the Taxable Goods class and you will notice a shiny new dropdown for assigning a Taxjar product category.

If you select Clothing and clicks Save Product Tax Class. So clothing tax exemptions applied. This tax will be applied to all products assigned to the Taxable Goods class. By doing this will not works just for new tax classes but existing product tax classes also.

Customer Exemptions : To use Customer Sales Tax Exemptions, you have to set their corresponding tax classes to exempt for checkout calculations. By clicking Customer Exemptions, exempt the class you would like to exempt and a dropdown will appear.With the use of Customer Exemptions, we can assign a Taxjar exemption type to each customer individually or multiple customers at once only if some of your customers are tax exempt.

After the dropdown shows up, select Yes and click Save Customer Tax Class. By doing this any customers associated with that customer tax class will be exempt from smartCalcs.

Enabling SmartCalcs : If you want to calculate sales, by default magento uses zip-based rates. But there is one problem by calculating taxes by zip code, there is no guarantee that you will be able to calculate the most accurate amount of sales tax. Zip codes can cover multiple districts, countries, cities and even states but these jurisdictions can have different rates. It depends on what product exemptions you want to sell and where but when you use zip-based rates there are limitations for figuring out sales tax. That’s why we can’t rely on it.

Module Detailing :

- Using Taxjar, you’re not going to miss a due date and it will automatically submits your returns to the states where you’re registered.

- Using taxjar, you can save hours on sales tax filings. For that you have to organise sales data into easy-to-read, exportable, return-ready state reports.

- If you want to get access to the Taxjar API and real-time sales tax rates at checkout, you have to update your account. It will not affect your site performance or page load times.

- If you want to know where your sales have met or exceeded the economic threshold in each state you have to import your sales data into Taxjar.

- The most important thing is the Customer Experience. Giving customers the best experience by having the world-class technology is key because your business is your passion.

- Taxjar experts always help to answer your questions with industry-leading support.

Module Status : This module is compatible with Magento 2.4.3